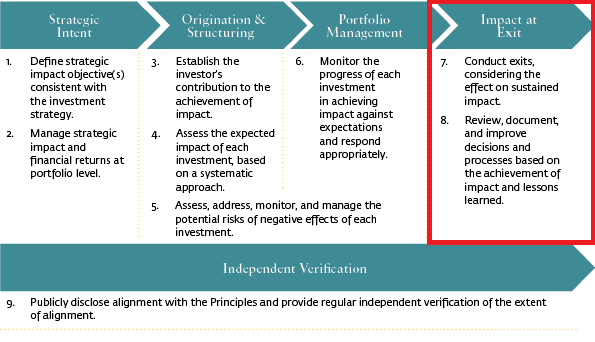

Operating Principles for Impact Management (the Principles) describe the essential features of managing investment funds with the intent to contribute to measurable positive social, economic, or environmental impact, alongside financial returns. This goes beyond asset selection that aligns investment portfolios with impact goals (for example, the SDGs), to requiring a robust investment thesis of how the investment contributes to the achievement of impact. The investor should conduct exits considering the effect on sustained impact, and review, document, and improve decisions and processes based on the achievement of impact and lessons learned.

OPERATING PRINCIPLES FOR IMPACT MANAGEMENT

The investor should, in good faith and consistent with its fiduciary responsibilities, consider the effect which the timing, structure, and process of its exit will have on the sustainability of the impact.

The investor should, in good faith and consistent with its fiduciary responsibilities, consider the effect which the timing, structure, and process of its exit will have on the sustainability of the impact.

The investor should also review and document the impact performance of each investment, compare the expected and actual impact, and other positive and negative impacts, and use these findings to improve operational and strategic investment decisions, as well as management processes.

Our blog series on the Impact Investing will look at each of the nine operating principles for impact management in more detail. See how the WOIMA waste-to-value solutions can help solve some of the core ESG challenges in emerging economies.

Find out more about us on WOIMA Company Brochure

Contact WOIMA, if you see yourself as collaboration partner in saving the planet. Ask more about turning waste into wellbeing with WOIMA Circular Economy Solutions.